As of 2026, the global seamless

steel pipe market exhibited a price trend of moderate increase with

regional differentiation. Key factors driving price fluctuations included:

rising raw material costs, increased energy costs, increased oil and gas

investment, the recovery of global infrastructure projects, and the impact of

geopolitics on logistics.

Global Seamless Steel Pipe Market Price

Trends

1. North America and Europe (Significant

Increase)

API series seamless steel pipes and

structural seamless steel pipes:

950 – 1150 USD/ton

Reasons for the increase:

Recovery of US oil and gas activity

(increased number of shale gas drilling rigs)

Continued demand driven by European energy

structure adjustments

Recovery in manufacturing PMI + increased

local labor costs

2. Middle East and South America (Strong

Demand for High-Pressure Energy Pipes)

Prices for oil casing pipes and line pipes generally rose due to the continued expansion of oil and gas

exploration projects:

Some API 5CT and API 5L high-grade

products: ≥ 1200 USD/ton

3. Southeast Asia and India (Relatively

Stable Prices)

Prices fluctuated less due to the release

of new local production capacity:

Structural pipes and medium- and

low-pressure fluid pipes:

850 – 980 USD/ton

Seamless Steel Pipe Price List

The

following are typical specification FOB price ranges for

international procurement reference.

Different countries, modes of

transportation, packaging, and certification requirements may cause some

fluctuations.

|

Metal Type

|

Standard

|

Length

|

Wall Thickness

|

Outer Diameter (OD)

|

Price Range (USD/ton)

|

|

Carbon

Steel Pipe

|

ASTM A106

|

6m

|

3.2mm

|

21.3mm

|

$720 – $780

|

|

Carbon Steel Pipe

|

ASTM A106

|

6m

|

4.5mm

|

33.7mm

|

$710 – $770

|

|

Carbon Steel Pipe

|

ASTM A106

|

6m

|

6mm

|

42.4mm

|

$700 – $760

|

|

Carbon Steel Pipe

|

ASTM A106

|

6m

|

8mm

|

48.3mm

|

$690 – $750

|

|

Carbon Steel Pipe

|

ASTM A106

|

6m

|

10mm

|

60.3mm

|

$680 – $740

|

|

Carbon Steel Pipe

|

ASTM A106

|

6m

|

12mm

|

76.1mm

|

$670 – $730

|

|

Carbon Steel Pipe

|

GB/T 8163

|

6m

|

8mm

|

89mm

|

$700 – $780

|

|

Carbon Steel Pipe

|

GB/T 8163

|

6m

|

12mm

|

114mm

|

$690 – $770

|

|

Carbon Steel Pipe

|

API

5L X42

|

12m

|

6.4mm

|

114.3mm

|

$750 – $850

|

|

Carbon Steel Pipe

|

API 5L X52

|

12m

|

8mm

|

168.3mm

|

$790 – $880

|

|

Carbon Steel Pipe

|

API 5L X60

|

12m

|

10mm

|

219.1mm

|

$820 – $920

|

|

Carbon Steel Pipe

|

API 5L X65

|

12m

|

12.7mm

|

273mm

|

$860 – $950

|

|

Carbon Steel Pipe

|

API 5L X70

|

12m

|

14.2mm

|

323.9mm

|

$880 – $980

|

|

Alloy Steel Pipe

|

ASTM A335 P11

|

6m

|

5mm

|

33.7mm

|

$1,080 – $1,200

|

|

Alloy Steel Pipe

|

ASTM A335 P11

|

6m

|

6mm

|

48.3mm

|

$1,100 – $1,250

|

|

Alloy Steel Pipe

|

ASTM A335 P22

|

6m

|

8mm

|

60.3mm

|

$1,150 – $1,300

|

|

Alloy Steel Pipe

|

ASTM A335 P5

|

6m

|

10mm

|

76.1mm

|

$1,200 – $1,350

|

|

Alloy Steel Pipe

|

DIN 2391 ST52

|

6m

|

3mm

|

42mm

|

$950 – $1,150

|

|

Alloy Steel Pipe

|

DIN 2391 ST52

|

6m

|

4mm

|

60mm

|

$970 – $1,200

|

|

Boiler

Tube

|

ASTM A192

|

6m

|

2.5mm

|

31.8mm

|

$920 – $1,100

|

|

Boiler Tube

|

ASTM A179

|

6m

|

2mm

|

25.4mm

|

$900 – $1,050

|

|

Stainless Steel Pipe

|

ASTM A312 TP304

|

6m

|

2mm

|

25.4mm

|

$3,600 – $4,500

|

|

Stainless Steel Pipe

|

ASTM A312 TP304

|

6m

|

3mm

|

48.3mm

|

$3,800 – $4,700

|

|

Stainless Steel Pipe

|

ASTM A312 TP316L

|

6m

|

2mm

|

33.7mm

|

$4,200 – $5,000

|

|

Stainless Steel Pipe

|

ASTM A312 TP316L

|

6m

|

3mm

|

60.3mm

|

$4,300 – $5,200

|

|

Oil Casing Pipe

|

API 5CT J55

|

9.3m

|

6.45mm

|

114.3mm

|

$1,100 – $1,300

|

|

Oil Casing Pipe

|

API 5CT N80

|

9.3m

|

7.5mm

|

139.7mm

|

$1,200 – $1,400

|

|

Oil Casing Pipe

|

API 5CT L80

|

9.3m

|

9.19mm

|

177.8mm

|

$1,300 – $1,500

|

|

Heavy Wall Pipe

|

Custom Spec

|

6m

|

25mm

|

323mm

|

$1,350 – $1,700

|

|

Precision Steel Pipe

|

EN

10305-1

|

6m

|

2mm

|

30mm

|

$1,100 – $1,350

|

2026 Seamless Steel Pipe Prices in China

Steel pipe prices fluctuated slightly. The market reference price for 20# seamless steel pipe was $541.31/ton.

Mainstream market price: Tianjin $561.36/ton. (Unit: USD/ton)

|

Product

|

Size (mm)

|

Grade (China)

|

Grade

(INT)

|

Price($/ton)

|

Remark

|

|

Seamless

Steel Pipe

|

Φ114*30

|

20#

|

ASTM 1020

|

545.59

|

Hot rolled

|

|

Φ426*11

|

20#

|

ASTM 1020

|

601.44

|

Hot rolled

|

|

Φ377*10

|

20#

|

ASTM 1020

|

601.44

|

Hot rolled

|

|

Φ325*9

|

20#

|

ASTM 1020

|

601.44

|

Hot rolled

|

|

Φ273*8

|

20#

|

ASTM 1020

|

577.10

|

Hot rolled

|

|

Φ219*6

|

20#

|

ASTM 1020

|

577.10

|

Hot rolled

|

|

Φ159*5

|

20#

|

ASTM 1020

|

577.10

|

Hot rolled

|

|

Φ60*5

|

20#

|

ASTM 1020

|

674.47

|

Cold drawn

|

|

Φ57*3

|

20#

|

ASTM 1020

|

671.61

|

Cold drawn

|

|

Φ48*3

|

20#

|

ASTM 1020

|

674.47

|

Cold drawn

|

|

Φ38*3

|

20#

|

ASTM 1020

|

703.11

|

Cold drawn

|

|

Φ32*3

|

20#

|

ASTM 1020

|

734.62

|

Cold drawn

|

|

Φ25*3

|

20#

|

ASTM 1020

|

834.86

|

Cold drawn

|

|

Φ219*70

|

45#

|

ASTM 1045

|

608.60

|

Hot rolled

|

|

Φ108*25

|

20#

|

ASTM 1020

|

538.43

|

Hot rolled

|

|

Φ121*20

|

20#

|

ASTM 1020

|

538.43

|

Hot rolled

|

|

Φ133*35

|

20#

|

ASTM 1020

|

544.16

|

Hot rolled

|

|

Φ140*20

|

20#

|

ASTM 1020

|

541.30

|

Hot rolled

|

|

Φ159*18

|

20#

|

ASTM 1020

|

552.75

|

Hot rolled

|

|

Φ180*30

|

20#

|

ASTM 1020

|

545.59

|

Hot rolled

|

|

Φ121*20

|

45#

|

ASTM 1045

|

551.32

|

Hot rolled

|

|

Φ133*30

|

45#

|

ASTM 1045

|

558.48

|

Hot rolled

|

|

Φ159*35

|

45#

|

ASTM 1045

|

562.78

|

Hot rolled

|

|

Φ180*40

|

45#

|

ASTM 1045

|

558.48

|

Hot rolled

|

|

Φ232*35

|

45#

|

ASTM 1045

|

558.48

|

Hot rolled

|

|

Φ76*4

|

20#

|

ASTM 1020

|

585.69

|

Continuous Rolled

|

|

Φ60*5

|

20#

|

ASTM 1020

|

591.42

|

Continuous Rolled

|

|

Φ89*4

|

20#

|

ASTM 1020

|

585.69

|

Continuous Rolled

|

|

Φ219*6

|

20#

|

ASTM 1020

|

561.34

|

Continuous Rolled

|

|

Φ325*8

|

20#

|

ASTM 1020

|

568.50

|

Continuous Rolled

|

|

Φ159*6

|

20#

|

ASTM 1020

|

554.18

|

Continuous Rolled

|

|

Φ108*4.5

|

20#

|

ASTM 1020

|

579.96

|

Continuous Rolled

|

Notes:

1. Prices above are ex-factory prices, including tax. A small delivery fee will be charged upon customer pickup. Shipping costs are not included.

2. The selection of domestic and international materials (grades) is based on publicly available data, choosing products with the closest specifications, but complete consistency of materials (grades) is not guaranteed.

3. The weights of the products in the table are the results of weighing at the time of the actual transaction.

4. Other commonly used materials include: Q235B/Gr.D/ss400, Q345/Gr.50/S335JO, 20Cr/ASTM 5120/SCr420, 40Cr/ASTM 5140/SCr440, etc.

Factors Affecting the Cost of Seamless

Steel Pipes

1. Raw Material Costs

Fluctuations in iron ore, scrap steel, and

coke directly impact production costs;

Stainless steel is most affected by nickel

prices: 316L > 304;

Higher material grades result in higher

costs.

Typical Price Difference:

316L seamless pipes are 3–4 times more expensive than carbon steel.

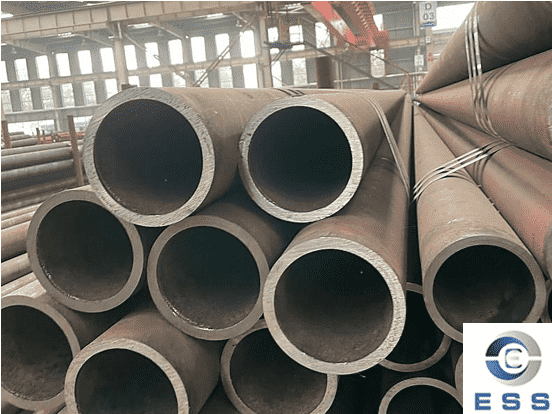

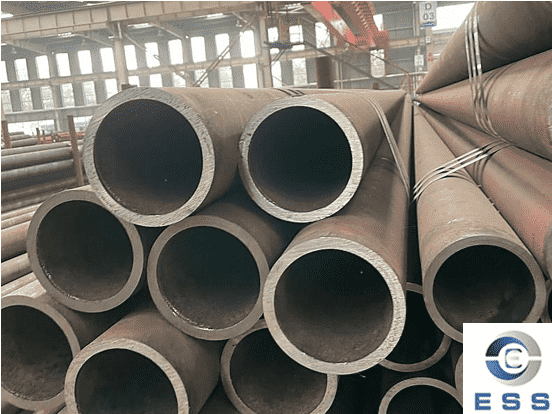

2. Manufacturing Processes and Equipment

The production of seamless steel pipes

requires specialized equipment and technologies, including hot rolling, cold

drawing, and heat treatment, etc.

Hot-rolled seamless steel pipes: Low cost,

moderate precision, lowest price.

Cold-drawn seamless steel pipes: High

precision, smooth surface, 10%–30% more expensive.

Heat-treated (normalizing, tempering)

seamless steel pipes: Improved mechanical properties, 30–80 USD/ton more expensive.

Ultrasonic testing, hydrostatic testing:

Meets high standards, 20–60 USD/ton more expensive.

Outer diameter (OD), wall thickness, and

length directly affect cost.

Increased OD increases cost.

A 100% increase in wall thickness increases

cost by almost 90–110%.

Custom lengths require additional

processing fees.

4. Material Grades and Quality Standards

High-grade steels and those meeting

stringent standards (e.g., API 5L, ASTM A335, EN 10216) require more rigorous

quality control and additional testing, including ultrasonic testing,

hydrostatic testing, and certification.

These quality assurance steps increase

costs but are crucial for demanding applications such as oil and gas pipelines

or high-pressure boilers.

5. Surface Treatment and Coating

Many seamless steel pipes undergo surface

treatments such as galvanizing, anti-corrosion coatings, or specialized paints

to extend their service life.

Depending on the coating method and

thickness, these treatments can increase the cost per ton of steel pipe by $100

to $500.

Black Painting: +10–25 USD/ton

3LPE/3LPP Anti-corrosion Coating: +80–150 USD/ton

Zipper: +120–500

USD/ton (varies with zinc prices)

6. Order Quantity and Delivery Time

Bulk orders typically enjoy volume

discounts because fixed setup costs and processing time can be spread over

larger quantities.

Conversely, small or urgent orders may

incur additional costs due to increased labor, setup, and expedited shipping

expenses.

7. Logistics and Origin

The origin of the steel pipe also affects

costs. Pipes from countries with lower labor and energy costs (such as China,

India, and Turkey) generally have lower upfront prices.

However, international shipping costs,

customs duties, and longer delivery times may offset these savings, depending

on your location.

FAQ

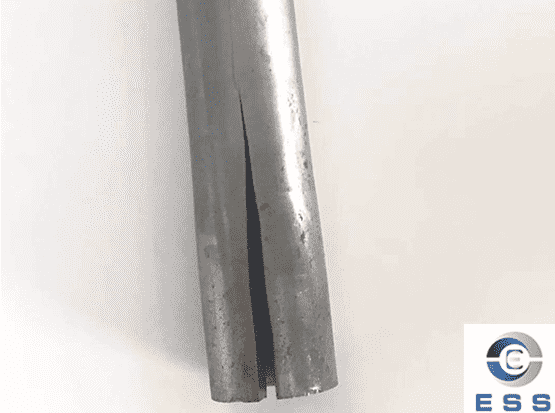

1. How much more expensive are seamless

steel pipes than welded

steel pipes?

Seamless steel pipes are typically 30% to

100% more expensive than welded steel pipes, depending on the material grade

and application.

2. Is seamless pipe more expensive?

Yes.

This is because its manufacturing

process is more complex, quality standards are higher, material selection is

more stringent, and more waste is generated during production.

Read more: Why Seamless Pipes Cost More Than Seam Pipes? or Seamless Pipe HS Code

Eastern Steel Manufacturing Co.,Ltd not only improve product production and sales services, but also provide additional value-added services. As long as you need, we can complete your specific needs together.

Eastern Steel Manufacturing Co.,Ltd not only improve product production and sales services, but also provide additional value-added services. As long as you need, we can complete your specific needs together.