What

is the HS code

HS code

is an internationally used commodity coding system, the full name of which is

"Harmonized Commodity Description and Coding System". It is

formulated by the World Tariff Organization (WTO) to classify and count

commodities for the convenience of international trade and customs management.

The HS code consists of 6 digits:

The

first two digits: commodity category

The 3rd

to 4th digits: secondary category

The 5th

to 6th digits: subdivided items

HS

code for precision steel tube

The HS

code for precision

tube mainly depends on multiple factors such as the type, purpose, material

and specifications of the product. The following are some common HS codes for

precision tubes classified by production process:

|

Classification

|

HS Code

|

Description

|

Application

|

|

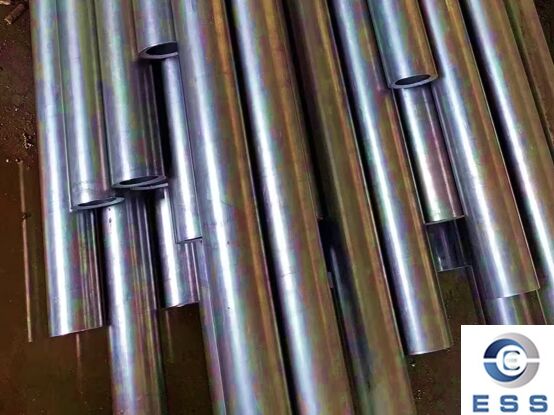

Seamless

precision tube

|

|

|

Carbon steel seamless

pipe

|

7304.19

|

Outer diameter ≤ 406.4mm,

non-boiler/geological use

|

Cold

drawn/cold rolled carbon

steel pipe (machine parts)

|

|

Alloy steel seamless pipe

|

7304.29

|

Outer diameter ≤ 406.4mm,

non-boiler/geological use

|

Precision

alloy steel pipe for automobiles

|

|

Stainless steel seamless pipe

|

7304.41

|

Outer diameter ≤ 406.4mm

|

Food

grade/medical equipment stainless

steel pipe

|

|

Other alloy steel seamless pipe

|

7304.49

|

Special alloy material, outer diameter ≤ 406.4mm

|

High

corrosion resistant industrial pipe

|

|

Welded

precision tube

|

|

|

Longitudinal submerged arc welded carbon steel pipe

|

7305.31

|

Outer diameter > 406.4mm, high pressure use

|

Oil and gas transmission pipeline

|

|

Other welded cold drawn/cold rolled pipe

|

7306.30

|

Outer diameter ≤ 406.4mm

|

Precision instrument thin-walled welded

pipe

|

Notes

1.

Specifications affect coding

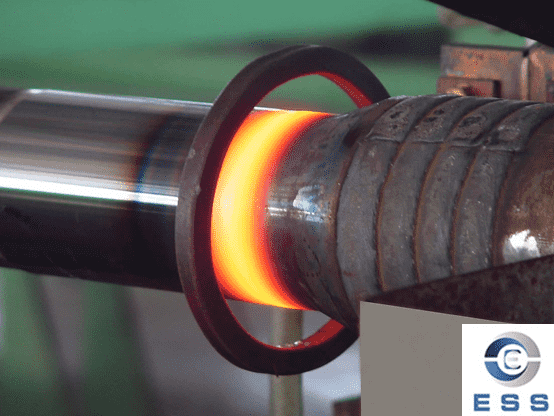

Outer

diameter, wall thickness, and processing technology (cold drawing/hot rolling)

may cause changes in the sub-items of precision tubes (such as whether the

outer diameter exceeds 406.4mm, 7304.19 and 7304.23 may be distinguished.).

2.

Usage description

It is

necessary to clarify whether it is used in special fields such as boiler

tube, oil and gas pipes, etc.

3.

Country differences

Some

countries add their own subdivision codes after the 6-digit HS code (such as

China's 10-digit tax number).

Purpose

of the customs code of precision tubes

The

customs code of precision tubes is very important in international trade, and

its uses are as follows:

1.

Customs declaration

In

international trade, each type of goods must have a specific customs code to

facilitate customs declaration, customs clearance, and tax management. The

customs code of precision tubes is 7304, which needs to be filled in when

conducting import and export trade so that customs can manage the goods.

2.

Customs tax management

The

customs code of precision tubes not only involves customs declaration, but also

tax management. Customs classifies goods according to their customs codes, and

different tax rates correspond to different customs codes.

3.

Statistical analysis

The

customs code of precision tubes not only plays an obvious role in customs tax

management, but also helps a lot in trade statistics analysis. By conducting

statistical analysis on different customs codes, we can have a comprehensive

understanding of the scale, structure, composition and other aspects of import

and export trade, and provide a basis for formulating relevant policies.

Summary

When

conducting import and export trade, correctly filling in the customs code of

precision tubes can help enterprises effectively avoid customs taxation and

other issues, thereby ensuring the normal operation of enterprises.

Read more: Seamless Steel Pipe Sizes

Eastern Steel Manufacturing Co.,Ltd not only improve product production and sales services, but also provide additional value-added services. As long as you need, we can complete your specific needs together.

Eastern Steel Manufacturing Co.,Ltd not only improve product production and sales services, but also provide additional value-added services. As long as you need, we can complete your specific needs together.