OCTG Pipe Import/Export Guide: HS Codes, Tariffs And Compliance

In global trade, the

import and export of OCTG pipe is an important part of the oil and gas industry. In order to

ensure the smooth progress of trade and avoid unnecessary risks, it is

important to understand the relevant HS codes, tariff policies and compliance

requirements. This article will provide you with a detailed OCTG pipe

import/export guide to help you better grasp these key information.

HS

Code

HS

Code is the basis of customs classification and is used to determine the tariff

rate and regulatory requirements of goods. For OCTG pipes, its HS code is

usually the following:

7304.11: Seamless steel pipe for drilling or oil production (drill pipe, casing pipe, etc.).

7304.19:

Other seamless steel pipes, which may include some special purpose OCTG pipes.

7306.30: Welded pipe for the oil and gas industry.

Tariffs

Tariff

policies vary from country to country, and here are some of the major markets:

1.

United States: According to the United States International Trade Commission

(USITC), import tariffs on OCTG pipes are generally based on the

most-favored-nation rate (MFN), and the specific rate may vary depending on the

product type and country of origin. For example, OCTG pipes imported from China

may face additional anti-dumping and countervailing duties.

2.

China: China's import tariffs on OCTG pipes are relatively low, with an MFN

rate of 0%, but the specific rate may vary depending on trade agreements and

countries of origin.

3. EU:

EU import tariffs on OCTG pipes are also based on the MFN rate, but may vary

depending on the country of origin and product type.

Compliance

1.

International Standards

API

5CT: This is a widely used standard in the oil and gas industry that specifies

the technical requirements for casing and tubing, including materials,

dimensions, mechanical properties, and test methods. Most OCTG pipes need to

comply with the API 5CT standard to enter the international market.

ISO

11960: This is a standard developed by the International Organization for

Standardization for pipes in the oil and gas industry. The standard imposes

strict requirements on the quality, size, mechanical properties and test

methods of pipes.

2.

Quality Certification

API

Certification: API certification is an authoritative certification in the oil

and gas industry, ensuring that the products meet international standards. Most

countries require imported OCTG pipes to be API certified.

ISO

Certification: ISO certification indicates the supplier's compliance with

international standards in quality management and production processes. Some

countries may require OCTG pipes to meet ISO standards at the same time.

3.

Environmental and Sustainability Requirements

Environmental

Requirements: Some countries have environmental requirements for the production

and use of OCTG pipes, such as limiting the use and discharge of hazardous

substances.

Sustainability

Requirements: Some countries encourage the use of sustainably produced OCTG

pipes, such as the use of environmentally friendly materials and energy-saving

production processes.

Trade

Process

1.

Import Process

Determine

the requirements: Determine the specifications, quantity and quality

requirements of OCTG pipes according to project requirements.

Select

Suppliers: Select suppliers that meet the requirements and ensure that their

products meet relevant standards and certifications.

Signing

a contract: Sign a contract with the supplier to clarify product

specifications, prices, delivery dates and quality assurance terms.

Handling

import formalities: Submit an import application to the customs and provide

relevant documents such as commercial invoices, packing lists, quality

certificates, etc.

Paying

duties and taxes: Pay duties and related taxes according to customs

requirements.

Clearing

goods: Complete customs clearance procedures and transport the goods to the

designated location.

2.

Export process

Understand

the requirements of the target market: Study the HS code, tariff policy and

compliance requirements of the target market.

Prepare

products: Ensure that the products meet the standards and certification

requirements of the target market.

Signing

a contract: Sign a contract with the customer to clarify product

specifications, prices, delivery dates and quality assurance terms.

Handling

export formalities: Submit an export application to the customs and provide

relevant documents such as commercial invoices, packing lists, quality

certificates, etc.

Paying

duties and taxes: Pay duties and related taxes according to customs

requirements.

Cargo

transportation: Arrange cargo transportation to ensure that the goods arrive at

the target market on time.

Summary

Understanding

the HS code, tariff policy and compliance requirements of OCTG pipe is the key

to ensuring smooth import and export trade. By being familiar with this

information, you can better plan the trade process and avoid unnecessary risks

and costs.

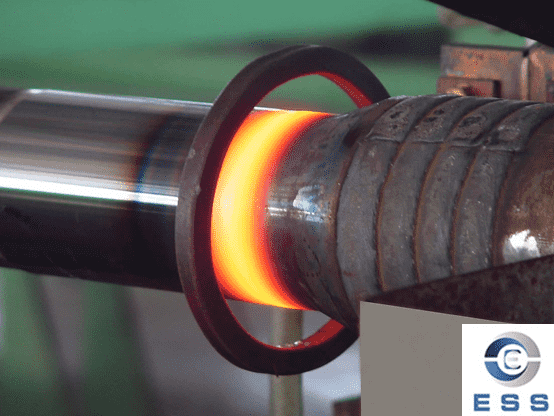

Eastern Steel Manufacturing Co.,Ltd not only improve product production and sales services, but also provide additional value-added services. As long as you need, we can complete your specific needs together.

Eastern Steel Manufacturing Co.,Ltd not only improve product production and sales services, but also provide additional value-added services. As long as you need, we can complete your specific needs together.