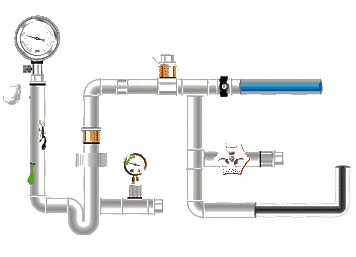

Hydraulic

tube, as an important component of hydraulic system, carries the important

task of transmitting hydraulic energy. In international trade, each commodity

has a specific customs code for accurate classification and identification. For

hydraulic tubes, its customs code is an important and necessary information.

What is HS code

The customs code is HS code, which is the

abbreviation of the coding coordination system. Its full name is

"International Convention for Harmonized Commodity Description and Coding

System", referred to as the Harmonized System (abbreviated as HS). It is a

multi-purpose international trade commodity classification catalog formulated

on the basis of the original Customs Cooperation Council commodity

classification catalog and the International Trade Standard Classification

Catalog to coordinate various international commodity classification catalogs.

The basic number of HS codes used

internationally is 6 digits. This 6-digit code contains the following three

parts:

The 1st-2nd digits: represent "class,

chapter". There are 21 classes in total (the class number is represented

by one digit, but the 21st class is represented by two digits, that is, Chapter

98), 97 chapters (Chapter 77 is left blank).

The 3rd and 4th digits represent the

heading. Each chapter is further divided into several headings according to

needs, represented by two digits. There are 1241 four-digit tariff headings in

total.

The 5th and 6th digits represent the

subheading. The heading is further divided into several subheadings according

to needs. The subheading code is composed of two digits added to the heading to

which it belongs. There are 5019 six-digit subheadings in total.

HS codes are not applicable to all

countries. HS codes are used in more than 200 countries and regions, but in

some countries and regions, due to their special trade or economic needs,

variants based on HS codes or self-designed coding systems may be adopted, such

as HTS codes and NCM codes.

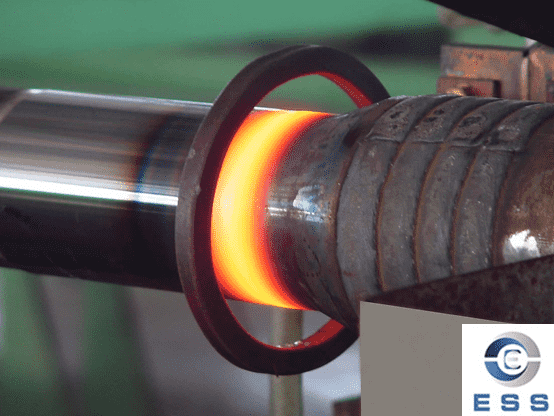

HS Codes for Hydraulic tubes

HS codes for hydraulic tubes may vary

depending on the pipe material and specific type, but they usually fall under

Chapter 73 (Articles of Iron and Steel), specifically 7304 (Seamless iron pipes

(except cast iron) or seamless

steel pipes, tubes and hollow

sections) or 7306 (Welded iron pipes or welded

steel pipes, tubes and hollow sections). For example, seamless iron or

steel hydraulic tubes are usually classified under HS code 730439 (cold drawn

pipes are further specified by subheading 73043919, etc.). If the pipe material

is a welded pipe, it may be classified under HS code 7306.

Below is a list of

HS codes for hydraulic tubes:

|

HS Code

|

Name

|

Export Tax Rebate Rate (%)

|

|

3917230000

|

Hydraulic tube

|

13%

|

|

3917310000

|

Hydraulic tube

|

13%

|

|

3917390000

|

Hydraulic tube

|

13%

|

|

4009120000

|

Hydraulic tube

|

13%

|

|

4009210000

|

Hydraulic tube

|

13%

|

|

4009220000

|

Hydraulic tube

|

13%

|

|

4009310000

|

Hydraulic tube

|

13%

|

|

4009320000

|

Hydraulic tube

|

13%

|

|

7306900090

|

Hydraulic tube

|

0%

|

|

7307290000

|

Hydraulic tube

|

0%

|

|

8412909090

|

Hydraulic tube

|

13%

|

|

7303009000

|

Iron hydraulic pipe

|

0%

|

|

7307220000

|

Hydraulic pipe elbow

|

0%

|

|

7307990000

|

Hydraulic

pipe fittings

|

0%

|

|

8412909090

|

Hydraulic steel pipe

|

13%

|

|

7304499000

|

Hydraulic steel pipe 18x1mm 4905A

|

0%

|

|

7304499000

|

Hydraulic steel pipe 5/8"x1.63mm,329bar

|

0%

|

|

7304499000

|

Hydraulic steel pipe 1/2"x1.63mm,329bar

|

0%

|

|

7304499000

|

Hydraulic steel pipe 28x1.2mm 4909A

|

0%

|

|

8307100000

|

Stainless steel wire hydraulic pipe

|

13%

|

|

7306690000

|

Stainless steel hydraulic pipe

|

0%

|

|

8307100000

|

Stainless steel hydraulic pipe

|

13%

|

|

8307900000

|

Copper hydraulic pipe

|

13%

|

|

4009210000

|

Steel braided hydraulic pipe

|

13%

|

|

4009210000

|

Rubber hydraulic pipe

|

13%

|

|

7411290000

|

Red copper hydraulic pipe

|

0%

|

Eastern Steel Manufacturing Co.,Ltd not only improve product production and sales services, but also provide additional value-added services. As long as you need, we can complete your specific needs together.

Eastern Steel Manufacturing Co.,Ltd not only improve product production and sales services, but also provide additional value-added services. As long as you need, we can complete your specific needs together.